Role of FEMA in Indian Export Import, In a world that thrives on global trade, the role of FEMA (Foreign Exchange Management Act) in India’s import-export industry cannot be overlooked. With its ability to regulate and monitor foreign exchange transactions, FEMA plays a crucial role in facilitating smooth trade operations while safeguarding the country’s economic stability. From ensuring compliance with international regulations to managing currency fluctuations, this article dives into the depths of FEMA’s influence on India’s export-import landscape. Join us as we unravel the intricate web of policies and measures designed to propel India towards becoming a global trading powerhouse.

Table of Contents

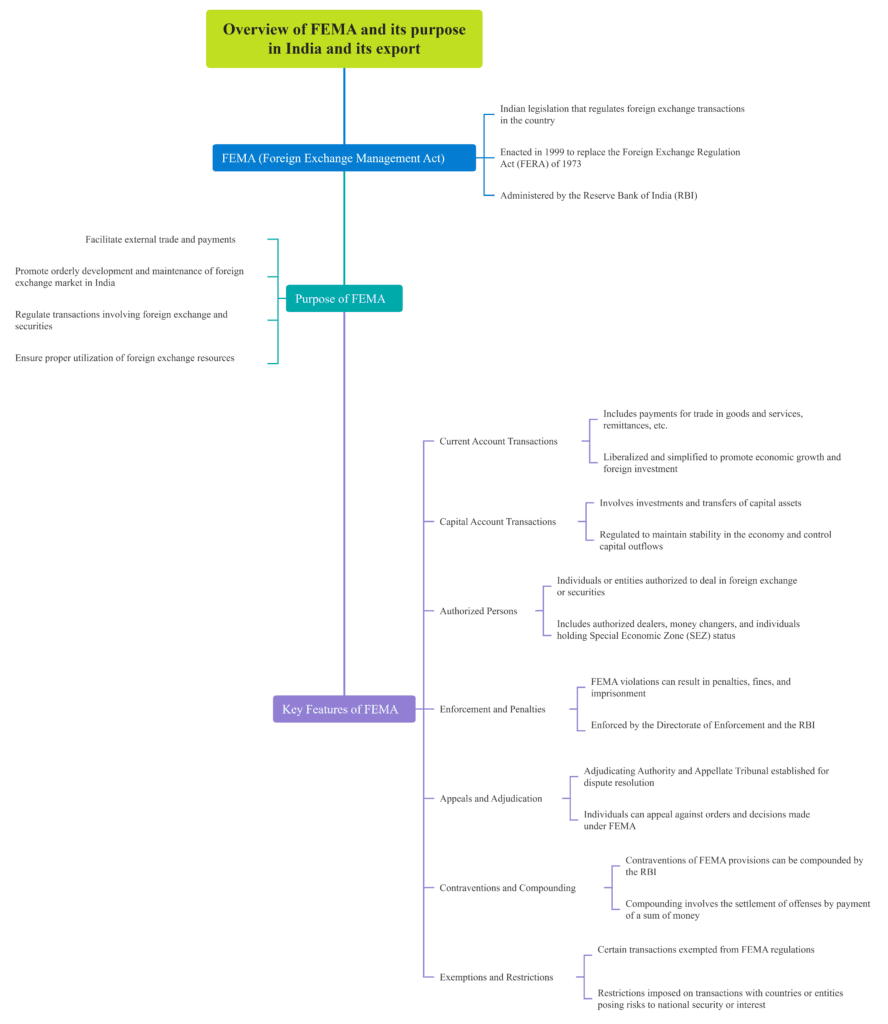

Overview of FEMA and its purpose

FEMA, short for the Foreign Exchange Management Act, is an important regulatory framework in India that governs all cross-border transactions involving foreign exchange and overseas investments. Its main purpose is to facilitate international trade and smooth foreign currency flows in and out of the country. FEMA was introduced in 1999, replacing its predecessor FERA (Foreign Exchange Regulation Act), and has since been instrumental in promoting transparency, efficiency, and stability in India’s export-import sector.

One of the key functions of FEMA is to regulate foreign direct investment (FDI) into India. It sets guidelines on the entry route for various sectors and defines the limits on equity participation by non-residents. By doing so, FEMA ensures that FDI inflows are channeled into areas where they will have a positive impact on economic growth while also safeguarding national interests. Moreover, FEMA also monitors outward remittances or overseas investments made by Indian residents, ensuring compliance with legal requirements and preventing unauthorized transactions that could pose risks to the country’s financial system.

In recent years, FEMA has undergone several amendments to keep pace with a rapidly changing global business landscape. The evolving nature of trade practices and increased cross-border collaborations necessitate regular updates to stay aligned with international standards. Consequently, FEMA serves as a vital tool for regulators to manage capital movements effectively while promoting ease of doing business both domestically and internationally. Undoubtedly, it plays an integral role in facilitating India’s export-import ecosystem amidst evolving market dynamics.

Overall ,FEMA acts as a comprehensive framework that governs foreign exchange transactions, capital flows, and external trade in India. It aims to promote financial stability, facilitate economic growth, and safeguard the interests of individuals and businesses engaged in international transactions.

One of the key objectives of FEMA is to regulate foreign exchange dealings in India. It provides guidelines for individuals and entities involved in buying, selling, or transferring foreign currency or securities. These regulations help maintain a stable exchange rate regime and prevent unauthorized activities that could disrupt the country’s financial system.

Role of FEMA in Indian Export Import Promotions

FEMA, or the Foreign Exchange Management Act, plays a crucial role in promoting export-import activities in India. It serves as a regulatory framework that governs foreign exchange transactions and ensures compliance with international trade policies. FEMA not only facilitates seamless cross-border transactions but also promotes investment and domestic production, thus contributing to the growth of the Indian economy.

One significant way FEMA supports export-import is by simplifying and liberalizing foreign exchange regulations. It allows businesses to freely import goods and services, while also encouraging the export of domestic products by providing certain incentives such as relaxation in documentation requirements, favorable taxation policies, and access to credit facilities. Moreover, FEMA promotes ease of doing business by streamlining procedures for obtaining necessary licenses and permits for participating in international trade.

Furthermore, FEMA acts as a legal safeguard against fraud and illegal activities in export-import transactions. The act provides stringent penalties for any violations related to cross-border money transfers or manipulation of foreign exchange rates. This helps maintain the integrity of Indian exports and imports while enhancing trust among both domestic and international stakeholders.

In conclusion, FEMA plays a pivotal role in promoting export-import activities in India by providing a robust regulatory framework that fosters transparency, simplifies procedures, and safeguards against fraudulent practices. Its implementation has been instrumental in creating an enabling environment for businesses to engage in international trade with confidence while driving economic growth through increased exports and diversification of import sources.

Regulatory framework for Role of FEMA in Indian Export Import

The regulatory framework for export-import under FEMA (Foreign Exchange Management Act) plays a crucial role in facilitating smooth and hassle-free cross-border trade. It provides necessary guidelines and regulations to ensure compliance with foreign exchange laws and prevents any misuse or malpractice. From obtaining import-export codes to monitoring forex transactions, the regulatory body closely monitors all aspects of international trade.

One key aspect of the regulatory framework is the requirement for exporters and importers to obtain an Importer-Exporter Code (IEC). This unique code serves as an identification number for businesses engaged in cross-border trade, allowing them to undertake import and export activities. The IEC helps track foreign exchange transactions related to import-export operations, promoting transparency and accountability.

In addition, FEMA mandates that all export-import transactions adhere to prescribed rules regarding payment mechanisms. It offers various options such as letter of credit (LC), advance payment, or documents against acceptance (DA). These mechanisms not only ensure secure payment but also mitigate the currency risk associated with fluctuating exchange rates. Compliance with these regulations safeguards both parties involved in an export-import transaction, promoting trust and reliability in global trade relationships.

Key provisions of Role of FEMA in Indian Export Import

Key provisions for exporters and importers play a crucial role in the smooth functioning of international trade. One such provision is the requirement to obtain an Importer-Exporter Code (IEC) from the Directorate General of Foreign Trade. This code acts as a unique identification number for businesses engaging in export or import activities, enabling them to avail various benefits and incentives offered by the government. It also helps in tracking and monitoring transactions, ensuring compliance with regulations.

Another significant provision is related to foreign exchange control under the Foreign Exchange Management Act (FEMA). Exporters are required to repatriate their export proceeds within certain prescribed time frames to maintain balance in foreign exchange reserves. On the other hand, importers need to comply with regulations pertaining to payment methods, documentation requirements, and customs procedures. These provisions help safeguard India’s foreign currency position and ensure transparency and accountability in cross-border transactions.

Additionally, exporters enjoy various facilities like duty drawback schemes, export promotion capital goods schemes, and export credit insurance that encourage overseas sales while mitigating risks. Importers benefit from exemptions or reduced customs duties on certain goods under free trade agreements or concessional schemes aimed at promoting domestic manufacturing industries.

By understanding these key provisions for exporters and importers, businesses can navigate through complex international trade processes more effectively. Compliance with FEMA regulations ensures smooth financial transactions while availing benefits offered by different incentive schemes further strengthens their global competitiveness. Overall, these provisions go a long way in fostering robust economic growth through balanced foreign trade opportunities.

Regulations and guidelines under Role of FEMA in Indian Export Import

Regulations and guidelines under the Foreign Exchange Management Act (FEMA) play a crucial role in ensuring smooth operations in the import-export industry in India. These regulations are designed to govern the foreign exchange transactions associated with export-import activities. By streamlining the process, FEMA aims to provide clarity and transparency, as well as minimize risks and promote business growth.

Under FEMA, exporters and importers are required to adhere to specific regulations related to documentation, time limits, licensing requirements, and reporting obligations. For example, all exports or imports above a certain threshold must be reported to the Reserve Bank of India (RBI) within a stipulated period. Additionally, FEMA categorizes goods for export-import purposes into prohibited items; restricted items that require special permissions; canalized items that can only be imported through specific agencies; and free items that require no restrictions whatsoever.

These regulations not only ensure compliance but also safeguard national security by preventing illicit trade practices such as smuggling or money laundering. Moreover, they contribute to maintaining a balanced foreign exchange rate by controlling capital flows in accordance with the economic policies of the government. Overall, adherence to FEMA guidelines is essential for exporters and importers alike as it helps them navigate smoothly through trade processes while adhering to legal requirements.

Benefits of Role of FEMA in Indian Export Import

One of the key benefits of FEMA (Foreign Exchange Management Act) for exporters and importers is the ease it brings to conducting international trade transactions. Under FEMA, exporters and importers have access to simplified procedures for remittances, allowing them to seamlessly transfer funds and settle their trades. This not only reduces administrative burdens but also facilitates faster payment processing, enabling businesses to streamline their cash flows and improve liquidity.

Another advantage of FEMA for exporters and importers is its provisions that allow them to hedge against currency fluctuations. By permitting foreign exchange derivatives such as forward contracts, options, and futures, FEMA provides a mechanism for businesses to protect themselves from potential losses due to volatile exchange rates. This allows exporters and importers to estimate costs more accurately, negotiate better prices with customers or suppliers abroad, and ultimately enhance profitability.

Challenges and limitations of Role of FEMA in Indian Export Import

One of the key challenges faced by FEMA (Foreign Exchange Management Act) in the realm of export-import is the ever-changing global economic landscape. The dynamics of international trade are constantly evolving, making it challenging for FEMA to keep up with the latest trends and regulations. This necessitates regular updates and amendments to ensure that FEMA remains effective and relevant in facilitating smooth transactions.

Another limitation faced by FEMA is its strict control over foreign exchange transactions, which can sometimes hinder the growth of export-import activities. While this control is necessary to maintain stability in the economy and prevent unauthorized outflow or inflow of funds, it can also restrict businesses from taking advantage of lucrative opportunities available abroad. Moreover, businesses often need to navigate complex regulatory procedures and meet various documentation requirements when dealing with foreign exchange under FEMA, further adding to their challenges.

These challenges and limitations underscore the need for continuous evaluation and improvisation of FEMA’s role in export-import activities. By understanding the dynamic nature of international trade and streamlining processes without compromising on security measures, FEMA stands a better chance at effectively facilitating India’s global commerce endeavors.

Conclusion: Recap of the Role of FEMA in Indian Export Import

In conclusion, the role of FEMA (Foreign Exchange Management Act) in Indian export-import cannot be undermined. It has provided a strong regulatory framework that ensures the smooth flow of cross-border trade and investments. By enforcing strict guidelines on foreign exchange transactions and facilitating investor protection, FEMA has instilled confidence among domestic as well as international businesses.

One key aspect of FEMA is its focus on promoting ease of doing business by simplifying procedures related to imports and exports. This has made it easier for Indian exporters to navigate complex customs processes and access global markets. Moreover, FEMA’s provisions regarding foreign investments have attracted significant capital inflows into the country, contributing to economic growth and job creation.

Moving forward, it is crucial for the government and relevant stakeholders to continue refining and updating FEMA in order to adapt to changing global dynamics. With the increasing integration of economies worldwide, ensuring a robust mechanism for managing foreign exchange becomes even more important. By striking a balance between safeguarding national interests and promoting international trade, FEMA will continue to play a vital role in shaping India’s export-import landscape.